Trump’s New Tariffs Put Pressure on China’s Auto Industry

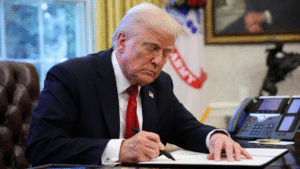

In a move that’s shaking up the global auto market, former U.S. President Donald Trump — now the Republican frontrunner for the 2024 election — has announced plans to impose steep new tariffs on Chinese electric vehicles (EVs) and auto parts. If implemented in 2025, the proposed tariffs could have far-reaching consequences for China\’s fast-growing auto sector and global supply chains.

The announcement, made in March 2025 during a campaign stop in Ohio, is part of a broader push for what Trump calls an “America First Auto Policy.” But for China’s automakers, especially EV giants like BYD and NIO, the rhetoric is already rippling through markets and investment strategies.

What Are the Proposed Tariffs?

Trump’s policy platform proposes:

- A 60% tariff on Chinese-made electric vehicles imported to the U.S.

- A 35% tariff on Chinese auto parts used in U.S.-assembled cars

- New restrictions on Chinese joint ventures in American automotive plants

While not yet enacted, analysts say the threat alone is already causing strategic shifts among manufacturers and suppliers worldwide.

Source: Reuters, March 8, 2025

Why It Matters: China’s Growing Auto Dominance

China has emerged as the world’s largest exporter of electric vehicles — surpassing Germany and Japan in 2023. Brands like BYD, XPeng, and NIO have expanded aggressively into Europe, Southeast Asia, and began targeting the U.S. market via strategic partnerships and contract manufacturing.

In 2024 alone, Chinese automakers exported over 1.2 million EVs globally, many of them priced significantly lower than Western rivals. Their cost advantage comes from strong domestic subsidies, vertically integrated battery supply chains, and government-backed infrastructure.

Trump’s proposed tariffs are aimed directly at countering this momentum.

Immediate Impacts on China’s Auto Sector

Even before implementation, the threat of tariffs has already begun to reshape the playing field:

- Stock prices of Chinese automakers dipped sharply following Trump’s March speech

- Several Chinese EV makers have paused expansion plans in the U.S. and are shifting focus to the Middle East and Latin America

- Parts suppliers — particularly battery and electronics firms — are exploring assembly hubs in Mexico and Vietnam to circumvent U.S. import taxes

Industry experts say that while Chinese EV makers have grown resilient, a 60% tariff would be a major blow to price competitiveness in the U.S. market.

Global Supply Chains and American Auto Prices

While the goal is to protect American industry, critics argue that Trump’s proposed tariffs could raise prices for U.S. consumers, especially in the affordable EV segment where Chinese brands were expected to compete aggressively.

Potential side effects include:

- Higher costs for U.S. automakers relying on Chinese parts

- Delays in EV adoption due to fewer affordable models

- Increased tension with U.S. allies trying to maintain trade with China

How China Is Responding

China’s Ministry of Commerce has criticized the proposed tariffs as “economic bullying” and is reportedly considering retaliatory measures against U.S. auto brands operating in China, including Tesla and Ford’s joint ventures.

Chinese media have also hinted at potential sanctions on rare earth exports — key materials for EV batteries — if tensions escalate further.

Meanwhile, Chinese companies are doubling down on localization strategies by expanding plants in non-U.S. markets, investing in overseas battery production, and lobbying through international trade bodies.

Conclusion

Trump’s proposed tariffs are reigniting U.S.-China trade tensions, with China’s booming auto industry caught in the crossfire. While the policy aims to revive American manufacturing, it may disrupt global supply chains, raise prices, and deepen the decoupling between the world’s two largest economies.

As the 2024 U.S. election looms large over global trade strategy in 2025, the automotive sector finds itself not just in a technological race — but in a political one.

Post Comment