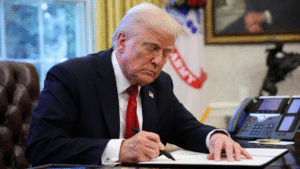

Bracing for Tariffs: How U.S. Businesses Are Preparing for a Possible Trump 2.0 Trade Agenda

With Donald Trump signalling a return to aggressive protectionist trade policies — including a proposed 10% universal tariff on all imports — U.S. businesses are already bracing for impact. While the 2024 election is months away, the private sector isn’t waiting around to prepare for a possible Trump 2.0 presidency.

From reshoring supply chains to pricing strategy overhauls, companies across industries are building contingency plans in anticipation of renewed tariffs, trade wars, and global economic uncertainty. Here’s how U.S. businesses are responding — and what’s at stake.

Trump’s Trade Signals: What’s on the Table?

In recent campaign rallies and interviews, Trump has hinted at:

- 10% across-the-board tariffs on all imports

- 60% or more tariffs on Chinese goods

- Revisiting NAFTA/USMCA terms and targeting EU exports

The former president’s rhetoric echoes his first-term trade approach, which led to tariffs on $360 billion in Chinese goods and retaliatory tariffs from major allies and competitors alike.

Many business leaders fear that Trump 2.0 could amplify existing trade tensions and provoke fresh rounds of global retaliation.

How Businesses Are Preparing Now

Even before election results are in, many U.S. companies are making strategic moves in anticipation of a more isolationist trade policy in 2025:

1. Diversifying Supply Chains

After learning hard lessons from COVID-19 and U.S.-China tensions, firms are accelerating “China+1” strategies — moving sourcing to Vietnam, Mexico, India, or even reshoring to the U.S. itself.

- Apple is increasing production in India and Southeast Asia

- Textile and auto manufacturers are building facilities in Mexico

- Semiconductor firms are investing in U.S. fabs via CHIPS Act incentives

2. Repricing Products and Building Inventory Buffers

Retailers and importers are re-evaluating pricing models to prepare for sudden cost increases from new duties. Some are stockpiling parts and materials now, betting that tariffs could hit in early 2025.

Example: Appliance and electronics makers are pre-ordering Chinese components ahead of a potential tariff wave.

3. Lobbying and Legal Strategy

Trade associations and Fortune 500 firms are already ramping up D.C. lobbying efforts. Their focus? Arguing for targeted tariffs rather than blanket levies and preparing litigation strategies to challenge sudden import taxes.

\”Blanket tariffs would hit U.S. consumers and workers just as much as foreign companies,” says John Murphy, Senior VP at the U.S. Chamber of Commerce.

Sector Spotlight: Who’s Most at Risk?

Industries highly dependent on global supply chains and imported goods stand to lose the most:

- Retail: Apparel, furniture, electronics — especially low-margin businesses

- Automotive: Parts and components from Asia, Mexico, and Canada

- Agriculture: Farmers fear retaliatory tariffs on exports, as seen in the 2018–2020 soybean standoff with China

In contrast, some U.S.-based manufacturers and domestic producers may benefit — at least short term — from reduced foreign competition.

What Markets Are Watching

Financial markets have taken note. Analysts at Bloomberg and Morgan Stanley have warned that a Trump victory could spike inflation, disrupt trade flows, and rattle investor confidence in multinational companies.

Some firms are adjusting earnings forecasts and currency hedges based on different political scenarios — a rare move this early in an election cycle.

Conclusion

Trump’s proposed return to hardline trade policies has put U.S. businesses on high alert. Whether or not he wins in 2024, the fact that so many companies are already preparing speaks volumes about the lasting uncertainty surrounding America’s role in the global economy.

In an era where trade, tech, and geopolitics are increasingly intertwined, adaptability may be the most valuable business asset of all.

Post Comment