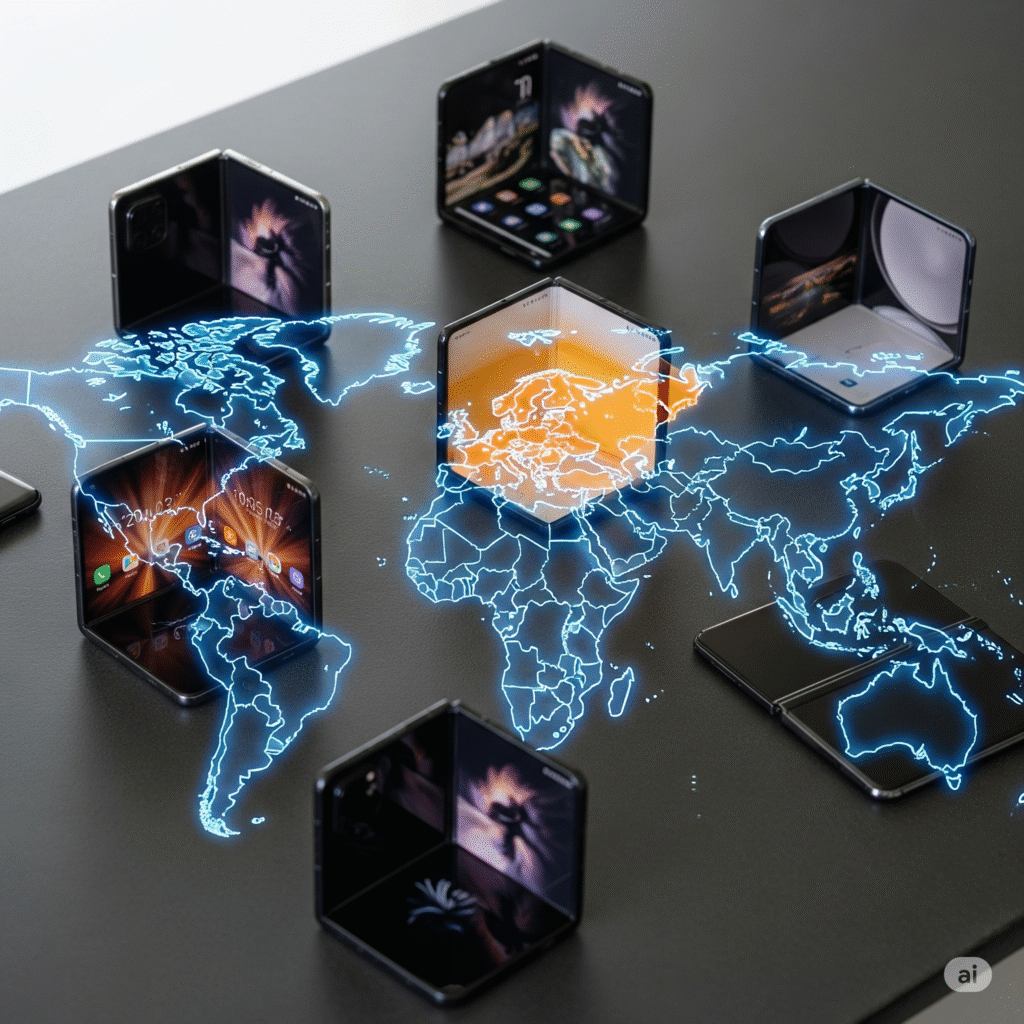

The global foldable smartphone market reached around 19.8 million unit shipments in 2025, holding roughly 1.5 % penetration of overall smartphone sales. Growth continues even as the broader market remains flat. (Cognitive Market Research; Reuters)

Samsung reclaimed the global smartphone lead in Q2 2025, shipping 57.5 million units—up 7 % year-on-year—with its Galaxy A-series and tablets driving sales. Foldables accounted for 4 % of Samsung’s handset shipments and 16 % of phones priced over US$800 in the quarter. (Canalys; Reuters)

Chinese Brands Push Foldable Innovation

Chinese manufacturers like Huawei, Oppo, Honor and Xiaomi are advancing foldable features at a faster pace. Innovations include tri‑fold designs, AI-powered software, stylus support, slimmer form factors and silicon‑carbon batteries. (Wired)

Huawei reclaimed top share in China’s smartphone market in Q2 2025 at 18 %, with Xiaomi close behind at 19 %, supported by domestic subsidies and strong demand for models like the Pura X and Nova 14 series. Vivo and OPPO share declined. (Reuters; Accio / Counterpoint)

Samsung Responds with Fold7 Design Overhaul

The Galaxy Z Fold 7 and Z Flip 7 debuted this quarter with improved hinge engineering, a 10 % lighter body, and a 26 % thinner profile than previous models. Samsung also introduced a budget Flip 7 FE priced at US$899. (Reuters)

Despite product updates, analysts say foldables still represent only about 1.5 % of total global smartphone shipments, limiting their overall financial impact. (Reuters; Cognitive Market Research)

Market Outlook and Future Catalyst

The anticipated launch of Apple’s first foldable iPhone in 2026 may significantly boost mainstream adoption. UBS analysis predicts a price of US$1,800–2,000—possibly lower than Samsung’s Fold7. (Tom’s Guide)

Analysts expect foldable device revenue to rise from US$31.3 billion in 2025 to US$118.9 billion by 2030—a compound annual growth rate of 30.6%—driven by lower cost, broader subsidy programs, and expanding AI integrations. (Mordor Intelligence)

Sources: Cognitive Market Research (market volume), Reuters (Fold7 and Samsung share), Canalys (vendor performance), Wired (Chinese innovation), Tom’s Guide (iPhone Fold pricing), Mordor Intelligence (market forecast), Accio / Counterpoint (China market share)