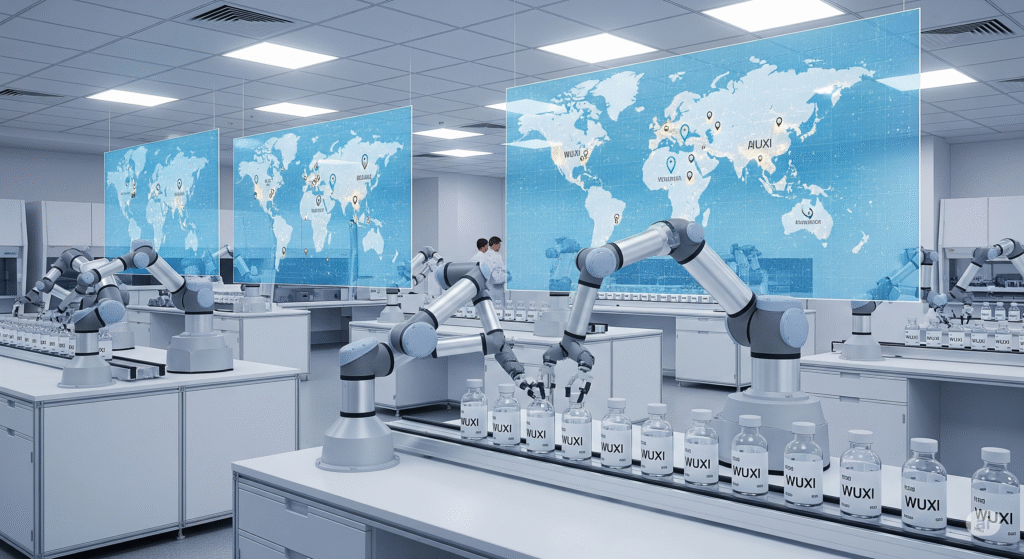

Chinese biotech services giant WuXi AppTec announced plans to raise approximately HK$7.70 billion (US$980.9 million) by issuing new H shares on the Hong Kong stock exchange. This move aims to support rapid global expansion of its drug development, contract research, and manufacturing services. (Reuters)

WuXi reported a more than 95% jump in half‑year net profit to RMB 8.29 billion (~US$1.15 billion). The company raised its full-year revenue forecast to RMB 42.5–43.5 billion. Management said the fresh capital will help scale both current and planned facilities worldwide. (Reuters)

Driving Global Growth in Biotech Services

WuXi provides contract development and manufacturing organization (CDMO) services to biotech and pharmaceutical firms globally. Its expansion strategy addresses rising demand from drug developers seeking integrated capabilities across preclinical to commercial stages. (Reuters)

The company has recently invested in new facilities across Asia, Europe, and the U.S. Proceeds from the share issue may accelerate project completion and facilitate technology upgrades. (Reuters)

Sector Poised for Recovery

After a sluggish 2024, biotech and pharmaceutical funding has renewed momentum. Contract research organizations (CROs) reported stronger-than-expected Q2 profits, signaling stabilization in drug R&D spending. (Reuters)

Analysts view WuXi’s raising move as well-timed, capturing increasing demand from global drug firms licensing molecules and outsourcing trials amid financial recovery. (TS2 Tech trend report)

Global Licensing Pivot Accelerates Demand

U.S. pharma firms are increasingly licensing experimental drugs from Chinese biotech players—such deals reached roughly US$18.3 billion in 2025 so far. This accelerates outsourcing demand, benefiting companies like WuXi. (Reuters)

Such partnerships shift focus from M&A to licensing and service outsourcing—where WuXi’s comprehensive platform positions it competitively. (Reuters)

Long-Term Strategy and Market Signals

WuXi’s plan to use net proceeds for global expansion reflects a long-term vision to become a go-to provider for biotech firms worldwide. Investors responded cautiously to the dilutive impact of new shares. (Reuters)

CEO Wei Liu emphasized that demand from both domestic and international clients remains strong and that expanding service footprint will help capture a growing share of the global CDMO market. (Reuters)

What Comes Next

The share placement offers will close in August, after which proceeds will be allocated across planned capacity projects. Investment in new labs, manufacturing lines, and AI-driven capabilities is already underway. (Reuters)

As global biotech investment rebounds and outsourcing expands, WuXi’s expansion strategy may reinforce its leadership in high-growth markets for pharmaceutical development. (TS2 Tech trend report)

Sources: Reuters (WuXi $980 m share raise), Reuters (CRO earnings recovery), Reuters (U.S. pharma licensing trend), TS2 Tech trend report (funding rebound)